Taxes Explained - Part 2

Today's Newsletter:

Quote from Anonymous

Current Year vs Future Year Benefits

A Money Question

Quote

“The best things in life are free but sooner or later the government will find a way to tax them.” - Anonymous

Death and taxes, the two absolutes in life. While we will all pay taxes, how we plan around them will have a direct impact on how much we pay and when we pay them.

What we get wrong about taxes?

One of the first things that comes to mind when asked about taxes is tax season. You know the time of year in April when you call your accountant for the first time in a few months. Maybe you discuss a few things that you could put down on your tax return in order to save some current-year taxes.

This right here is where the problem lies.

If you are just reporting on your taxes and not actively planning around them, you are bound to pay more. You might win the battle (that year’s taxes) but you are losing the war (your lifetime taxes).

For years, I thought about what I could do to lower my tax bill. Every year I would work with my accountant to find ways to “get money back” on my tax return. I thought I was winning the game. The truth is it was better than nothing but I didn’t understand what game I should be playing.

There is no way around taxes. Everyone pays them and if someone says they aren’t paying them and living in the United States of America, be weary. With that said, choosing to think about taxes as a lifetime game and not a yearly one is the first step to gaining the upper hand on your tax bill.

Let’s dive in.

Current Year vs Future Year Benefits

The easiest way to think about tax strategy is current year versus future year benefits. The easiest way to decide if you should look at a current-year option or a future-year option depends on your current personal tax rate and what you think it will be in the future.

Example: If you are in the highest tax bracket today (37%) but think you will be in a lower bracket in the years to come, focus on current-year benefits. If you are in a lower bracket today and think you will be in a higher one in the future, focus on future year benefits. This is oversimplified but the point remains.

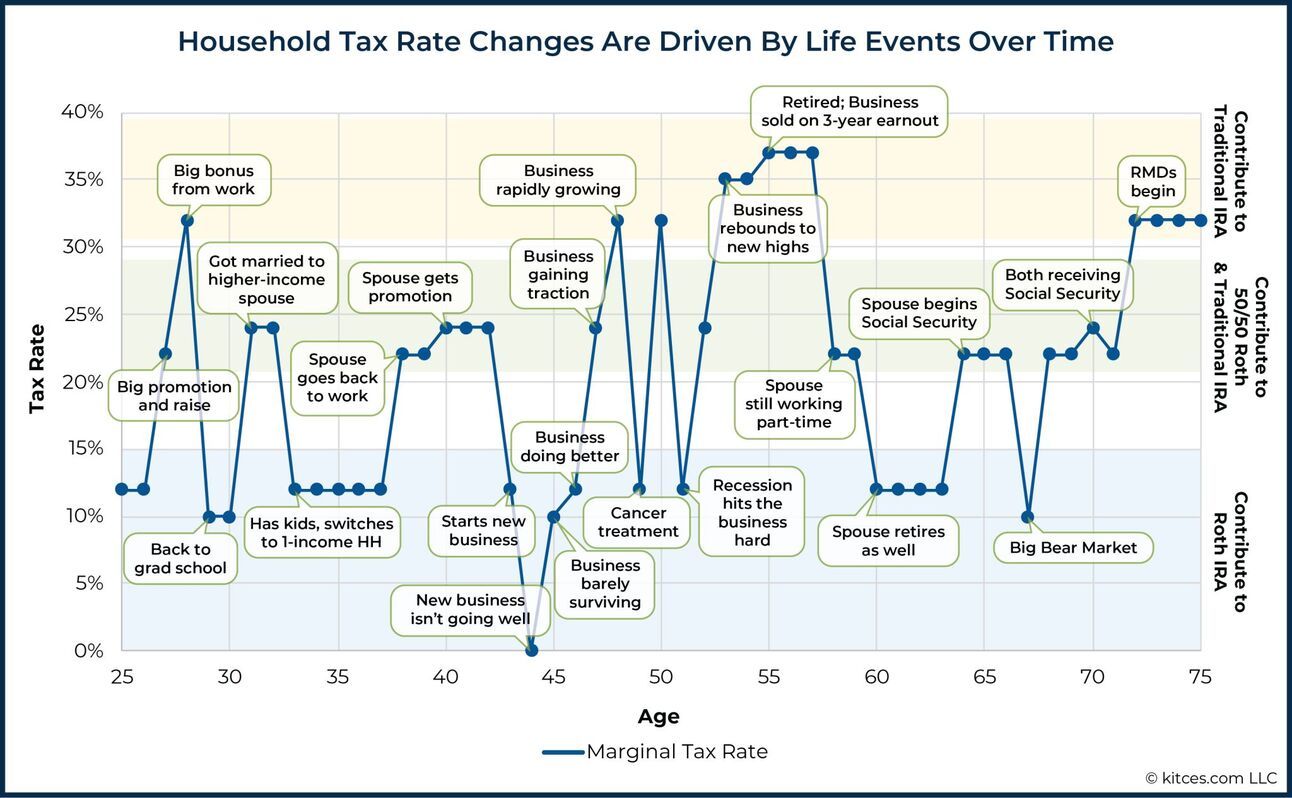

As we go through life, our tax bracket ebbs and flows based on events. This graphic outlines the “tax bracket life” of a business owner.

The majority of current-year benefits come in the form of “tax deferral” opportunities.

Here are a few examples:

Contributing to a 401(k)

Contributing to a traditional IRA

1031 exchange of a real estate property

The majority of future-year benefits come in the form of “tax-free” opportunities.

Here are a few examples:

Contributing to a Roth 401(k)

Contributing to a Roth IRA

Creating a future year tax asset through tax loss harvesting

The point of today’s newsletter is not to talk at length about the endless strategies that you can use but rather to get you thinking about taxes in a different way.

The quickest way to get the upper hand on your tax bill is to understand you are playing a lifetime game, not a yearly one.

There are often times with my clients that I am recommending we pay more in taxes in a given year. It stings writing the IRS a check that you don’t have to. Yet, when we implement planning strategies that require current-year tax payments, it often saves us thousands in future-year tax liabilities. Pain today but gain tomorrow.

This is the most common tax mistake I see families make. They plan for the next year or two but they don’t project out 5,10,15 years into the future. Look, I get it things change over time but taxes will always be there.

You can either choose to plan around them now or pay unnecessary taxes over the course of your lifetime.

A Money Question

What is your perfect outcome?

I recently gave a talk on the “perfect outcome”. It revolved around athletics and the focus was on things that you can control. I propose the same question to you when it comes to your finances. What are you striving for? Is that outcome in your control? What can you do to get there?

Work with Jacob

I help athletes, entrepreneurs, and executives pay less in taxes, simplify their financial lives, and invest for the long run.

Until Next Time, My Friends

Moment Private Wealth, LLC is a Registered Investment Advisor, located in the State of Missouri. Moment Private Wealth provides investment advisory and related services for clients nationally. Moment Private Wealth will maintain all applicable registrations and licenses as required by the various states in which JL Strategic Wealth conducts business, as applicable. Moment Private Wealth renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion. Nothing in this content is intended to be, and you should not consider anything in this content to be, investment, accounting, tax, or legal advice.