Staying Rich is Harder

Today's Newsletter:

My Latest

The Challenge in Staying There

Staying Rich is Harder

A Money Question

My Latest

The World Series is upon us, and you are going to be ready with insider information.

My latest shows you an inside look at the MLB Playoff Bonus Pool:

Who gets paid

Players only meetings

What happens behind the scenes

You can check it out here ⬇️⬇️⬇️

The Challenge in Staying There

“It is easier to get to the big leagues than it is to stay there.”

Let me take you back to 18-year-old Jacob.

My first experience in professional sports was something called instructional league.

Teams used it as a way for new draftees and younger prospects to “get their feet wet”.

We learned:

What it looked like to be a pro

Got an introduction to the support staff

Everything we needed to hit the ground running for spring training

One of the biggest things I learned at instructional league was this:

It will never get easier.

As you move up from Rookie Ball to Low A to AA to AAA, you can never fall into the trap that you have made it.

In fact, with each level, it becomes harder not only to get to the next level but simply to stay at the current level.

Our coaches beat this into our heads with this mantra ~ “It is easier to get to the big leagues than it is to stay there.”

As an 18-year-old you brush it off.

Yet a few years into my career, it was crystallized in my brain.

Consider that each year, a team is drafting 20 new players, signing both minor league and major league free agents, and bringing in the best talent from outside the US.

You have to compete against that influx every year just to stay where you are.

Well, I was thinking this week about how that same holds true for keeping wealth or “staying rich”.

I have the opportunity to walk alongside families who have “made it” in every aspect of their financial lives.

Yet one thing I need to clarify is that “making it” does not mean you now have access to less complexity, a silver bullet, or some far-off strategy other people don’t.

In fact, it is quite the opposite ~ You have to plan just as carefully (if not more) to stay there.

That is what we are going to talk about.

Oh, and don’t worry, if you have made it, there will be some golden nuggets no matter your stage in the wealth-building journey.

Let’s dive in…

______________________

Staying Rich is Harder

I am going to break this down into three sections.

We are going to talk about planning, taxes, and investing.

In each, we are going to diagnose why building wealth and staying wealthy are vastly different concepts, and the considerations with each.

Planning

I am going to make an assumption here, but if you are reading this newsletter, you have some interest in getting smarter with your money.

So my guess is you want to put yourself in a better financial position than you are today.

Well, to do that, you have to start with the foundation.

Ya like the plan.

Ain’t no one driving across the country without a map.

You need to think about building wealth the same way.

So how does one build wealth…

The quickest, simplest answer I can give you to build wealth is to increase your income.

The quickest, simplest answer I can give you to increase your income is to take risks.

The quickest, simplest answer I can give you is to burn the boats.

If you really want to build wealth, you have to bet on yourself.

You cannot have a plan B; you have to burn the boats.

Now here is the problem ~ If you are in the camp of having built wealth, the above does not apply.

You quite literally should be doing the opposite:

Reducing income and focusing on experiences/impact

Reducing risk and focusing on preservation

Reducing concentration and adding optionality

See how weird that is?

You do one thing to build it, but to keep it requires a 180-degree shift (which makes it harder).

Starting to see my point?

Let’s talk taxes…

Taxes

Yes, I don’t like paying taxes.

Yes, I still pay taxes.

There is no secret formula to paying no taxes.

Ok, can I just stop now on this one?

No…let’s crystallize this a bit more.

As you are building wealth, you should be focused on reducing taxes.

Level one strategies should be your focus:

Retirement Accounts

Tax-Efficient Investing

Entity Strategy & Selection

P.S. If you want a team to help you execute on all of that, this is what we do at Moment every day.

You do this for a decade or so, and boom, you have built real wealth.

So you tend to think well now, now I am ready for the big leagues.

Give me the tax stuff that I can only do with the millions of dollars I have.

And crickets….

Well, not really, there will be plenty of people who will show you the most elaborate tax strategies.

Ways you can take leverage, get huge deductions, and redline your audit risk.

If you want to do that, be my guest; it just isn’t going to be with me.

Now, let me be clear, there are tax planning levels past level 1.

Things like thoughtfully owning real estate, utilizing trusts, and making “tax-centric” investments can be great things.

Yet what makes it harder is that once you become rich, you then have to figure out what is good and who is full of it.

I am going to let you in on a little secret…

Most people parading around as “tax strategists” bashing CPAs are glorified salesmen getting a big commission checks for every strategy they use.

Avoid this at all costs…

Starting to see how staying rich might be harder than getting rich…

Let’s talk investments…

Investments

I have built an eight-figure net worth on boring.

No, like really, really boring ~ Index-like investment that has just compounded with time.

My strategy is this ~ Tax Efficiency + Time + Not Tinkering + Ignoring the Noise = Wealth.

My wife and I’s wealth is quite literally the poster child for not doing anything fancy.

So if you are in your wealth-building journey, my “not financial advice” to you is stick to boring.

Ok, so let’s say you have built real wealth.

You are ready for the next stage of your investment journey.

You have heard your friends nonstop talking about their big wins.

You have seen Tony Robbins telling you that Private Equity is the way.

You have seen the media tell you it is time to make a big shift to crypto.

Well, what if I told you the best course of action might just be sticking to boring?

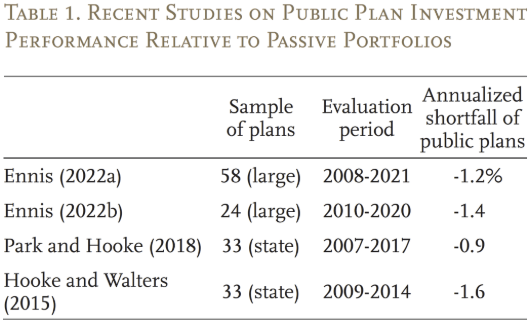

Take public pensions as your cautionary tale.

These pension fund managers love to add complexity, and they are some of the smartest people in the room.

Well, they are underperforming their index counterparts…

What having wealth allows you to do is take risks with a portion of your money.

It allows you to dabble outside of the core (boring) portfolio.

Yet what makes it hard is you:

Have more opportunities

Have to say no to 95% of everything

Have to increase your discipline as your wealth grows

It is hard. Trust me, I know. I want the cool, fancy investment just like you.

Yet I go back to some sage advice from my dad, “If it isn’t broke, why fix it?”

______________________

My friends getting rich is just step one.

Staying rich is step two.

I would argue that staying rich is actually harder.

It requires a mindset change, a tight filter, and David Goggins level discipline.

The noise, the opportunities, and the desire to do something will only grow.

Yet let me remind you, “Getting to the big leagues is easier than staying in the big league.”

Until next time, my friends!

____________________

A Money Question

Are your financial strategies tied to your desired outcomes?

I don’t typically propose yes or no questions, but here we are.

You should not do any planning or investing until you have clarity on the outcome you are trying to create.

It would be like buying a car without thinking about the seating you need, the experience you want, or the cargo capacity required.

______________________

3 Ways I Can Help You

💰 Schedule an introductory call with Moment. We help athletes, entrepreneurs, and key employees build and protect wealth.

📹 Check out my YouTube channel. A safe place to get smarter with your money.

📷 Interact with me on Instagram. I provide bite-sized daily content to level up your money game.

Moment Private Wealth, LLC is a Registered Investment Advisor, located in the State of Missouri. Moment Private Wealth provides investment advisory and related services for clients nationally. Moment Private Wealth will maintain all applicable registrations and licenses as required by the various states in which Moment Private Wealth conducts business, as applicable. Moment Private Wealth renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or under an applicable state exemption or exclusion. Nothing in this content is intended to be, and you should not consider anything in this content to be, investment, accounting, tax, or legal advice.