Metrics That Matter

Today's Newsletter:

My Latest

Metrics That Matter

Money Metrics To Focus On

A Money Question

My Latest

I love to walk.

As in every morning without fail you will find me walking. Most mornings I will listen to a podcast and one that is a bit of a guilty pleasure is The Dave Ramsey Show.

For those who don’t know who Dave is, Dave Ramsey is a legend in the personal finance space.

Some love him, some hate him but he shoots it straight and his show is full of people calling in with questions.

I love the concept so I am doing a monthly video on YouTube called The Reddit Rundown where I answer five questions from the Reddit personal finance forum.

You can check out the video here.

Metrics That Matter

I am always thinking ahead. I think it comes from my combined life experiences of never knowing where I would be next with baseball to having four kids 8 and under.

My life has been and still is full of unknowns.

Yet each time there I am always trying to determine which way the next path will lead even when I can’t see through the forest yet.

There are a million things to consider but the focus should be on what truly matters.

So consider for a second, you are in a new city, your rental car acquired, and you are leaving the airport.

Well if you are anything like me, you don’t type in your location until you are out of the exit just seconds away from making the most important decision of the trip.

Do I turn left or right out of the airport?

Yet the GPS is telling you about your three options, mapping out the time, and letting you know if there are any tolls.

Like come on, I don’t need to know about tolls at a time like this just tell me left or right.

Personal finance is a lot like that GPS, there are a million things you could know but often there are a few key metrics (like that left or right turn) that make all the difference.

Today, I want to discuss five key metrics I come back to for building wealth.

Let’s dive in!

______________________

Money Metrics To Focus On

Income

Before I talk about income, I am in the camp opposite of the FIRE movement. If you are not familiar with the FIRE movement it stands for Financial Independence Retire Early.

In theory that sounds great.

In practice, I see a lot of people boasting about how little they spend so they can have independence and never work again. If that is you, more power to you but that is not me.

Instead, I want independence but I want to live a life that is full of things that I enjoy. That means you won’t see me driving around a car with 200,000 miles or flying Frontier to save a buck.

I tell you this because the metric that matters the most is income. You need to find ways to increase your income over your working years.

It is the single biggest controllable you have.

Want to save more? Increase income

Want to invest more? Increase income

Want to create independence? Increase income

It is also the first metric that you should focus on. The reason is simple, the first and best investment you can make is investing in yourself. The S&P 500 will never be able to outpace what investing in you will.

Invest In Yourself ➡️ Increase Your Skills ➡️ Increase Your Income

It is like that left or right out of the airport, it is the metric that dictates everything else.

Savings Rate

Once we increase our income, we need to consider the next metric, our savings rate.

I am going to make a bet that if you are reading this newsletter you are ahead of 90% (probably more) of the population when it comes to money.

I will tell you this ~ behind that $100,000 SUV your neighbor bought or that fancy vacation your friend went on is typically a net worth statement that would shock you.

Time and time again this is what I see:

Big Income ➡️ Big Lifestyle ➡️ Little Savings

This is why I use the metric, “savings rate”, not the amount saved. You see early on in your wealth-building journey I want you to focus on the rate at which you save.

Here is an example:

If your goal is to save 20% of your income it works like this.

$100,000 means you save $20,000 ➡️ Salary increases to $125,000 means you now save $25,000.

Using a savings rate over a specific number ensures that as your income grows (the most important metric) so does your net worth.

I only recommend a specific dollar amount for clients once they have established a baseline of spending less than they make.

Before that, I always focus on the savings rate.

Tax Rate

Fun fact, there is no way around paying taxes. I know, I know some TikTok guru had you convinced there is a secret strategy you have never heard of that will allow you to avoid all taxes.

Sorry to burst the bubble, but that isn’t true.

The good news is you can (legally) reduce your tax bill.

The third key metric to focus on is your tax rate. Now before you say, well I earn so much I am in the highest tax bracket no matter what, listen to this…

The focus should not be on your yearly tax rate but rather on your lifetime tax rate.

You will pay taxes every year you earn money, the amount you pay over your lifetime will be far lower if you have a focus on the planning, strategies, and implementation available to reduce it.

It is something I have a near obsession with for our clients at Moment. If you like the idea of paying less in taxes, maybe we should talk (Schedule a call).

You can increase your income, set a healthy savings rate, and still miss out on big money without also focusing on taxes.

Plan Now or Regret It Later.

Offense vs. Defense

The number one driver of your investment returns is….take a guess.

The percentage of money you have positioned towards offense versus the amount of money you have positioned towards defense.

In financial advisor land, we call this asset allocation.

In real life, I like to think about this as offense vs. defense.

It makes sense, those that take on more risk have been rewarded with higher rates of return.

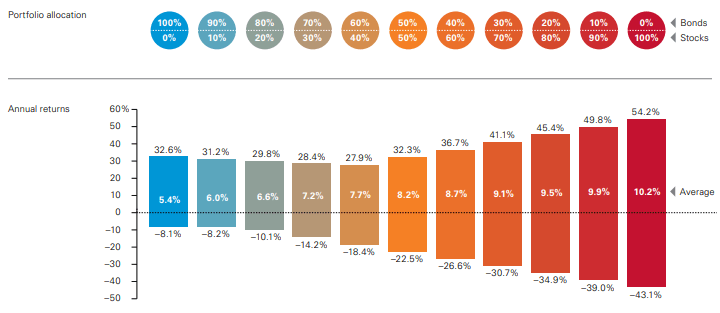

Take a look at this chart from Vanguard on the difference in return between a 100% defensive portfolio (Blue) and a 100% offensive portfolio (Red).

The blue has averaged a 5.4% return.

The red has averaged a 10.2% return.

The vast majority of investors have done little planning to understand the role of risk, how to think about it, and how to build a portfolio designed for them.

For our clients, we want to take on as much risk as possible while still preserving their current lifestyle.

This gives them the best of both worlds.

Peace of mind to sleep at night.

Ability to earn the highest possible rate of return.

An action item for those reading is to look at your current investment mix and see how much you have positioned towards safety and how much you have positioned towards growth.

Years of Return

One of my favorite stats in personal finance revolves around the legendary investor Warren Buffett.

Buffett whose net worth is north of $130 Billion accumulated more than 99% of that after his 50th birthday.

The context behind that stat is even crazier, there wasn’t some home run investment that allowed him to do that.

He was the same legendary investor before the age of 50.

So what changed?

Well nothing, time just went on. You see the metric that I love to track isn’t yearly return but rather years of return.

I mean think about it ~ If money doubles every 9 years (8% return). That means a $1,000,000 nest egg grows like this:

$1,000,000 ➡️ $2,000,000 ➡️ $4,000,000 ➡️ $8,000,000 ➡️ $16,000,000

The most important double is always the next one.

The key factor in that next double? Years of Return.

So, the next time you are considering an investment opportunity, consider asking yourself ~ “How long am I willing to stick with it?”

Sure a yearly rate of return matters but the real wealth is built in the years of return.

______________________

Personal finance can be overwhelming.

Browse online for a few minutes and you will quickly feel like there are endless things to consider. While there are plenty of variables, the key is focusing on what moves the needle.

These five metrics should serve as your foundation.

Until next time my friends!

______________________

A Money Question

What metric is the most important to you?

As I think through these five metrics, I realize that for many of my clients, the “most important” metric is different for many.

What is the most important changes based on your experience, stage of life, and current goals.

So which one is most important to you?

______________________

3 Ways I Can Help You

💰 Schedule an introductory call with Moment. We help athletes, entrepreneurs, and key employees build and protect wealth.

📹 Check out my YouTube channel. A safe place to get smarter with your money.

📷 Interact with me on Instagram. Where I provide bite-sized daily content to level up your money game.

Moment Private Wealth, LLC is a Registered Investment Advisor, located in the State of Missouri. Moment Private Wealth provides investment advisory and related services for clients nationally. Moment Private Wealth will maintain all applicable registrations and licenses as required by the various states in which Moment Private Wealth conducts business, as applicable. Moment Private Wealth renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or under an applicable state exemption or exclusion. Nothing in this content is intended to be, and you should not consider anything in this content to be, investment, accounting, tax, or legal advice.