Investing in 2023

Today's Newsletter:

Quote from Warren Buffett

What Matters Today

A Money Question

Quote

“The difference between successful people and really successful people is that really successful people say no to almost everything .” - Warren Buffett

Take a minute and think about this. While this quote was certainly directed at investing, it applies to life in general. In life, we are uniquely positioned to win at certain things. Find that thing and push away the rest. In investing, a prerequisite to winning is being able to say no to 99% of your opportunities. Find the 1% that makes sense and stick to them like glue.

What Matters Today

Recent newsletter episodes have been a mix of frameworks, ideas, and planning. Today I want to pull back the curtain on how I think about investing in today’s market for myself and my clients. Notably, I talk more about planning opportunities, tax strategies, and frameworks than what investment will provide the highest return. I do this for one reason, investments at their core are a matter of opinion. There have been countless investors that have all invested in different ways and achieved success.

So, if investments are a matter of opinion and there is more than one way to be successful ~ What should we focus on?

Picture yourself at a poker table. Except at this table, you don’t have to anti (pay to get your cards). Instead, you can wait until you get the perfect two cards before you ever decide to play. If you are like me, you would wait until you have pocket aces. For those that don’t play poker that is two aces or said more simply the best starting hand you can have. I think about investing the same way. You can and have the power to stack the odds drastically in your favor.

Today we are going to look at how I think about stacking the odds in my favor. JP Morgan’s Guide to the Markets is something I read each quarter. We are going to use four charts from their latest edition to frame today’s newsletter. If you like investing, it is arguably one of the best resources available.

1) Diversification

What is this:

This is what the power of diversification looks like in a chart. On the top, we have the individual years from 2008-2022, Year to Date, and Annualized. The different colors each represent a different section of the market from large-cap stocks (Apple) to REITs (Real Estate) and everything in between.

Why does it matter:

The best way to get your fair share of the market return is to diversify. Take a hard look at this chart, are there any patterns that emerge? Let me save you your Sunday, there isn’t. There is a level of randomness to yearly returns in the stock market. Owning different segments of the market is a foundational element to stacking the investing odds in your favor.

2) US versus International

What is this:

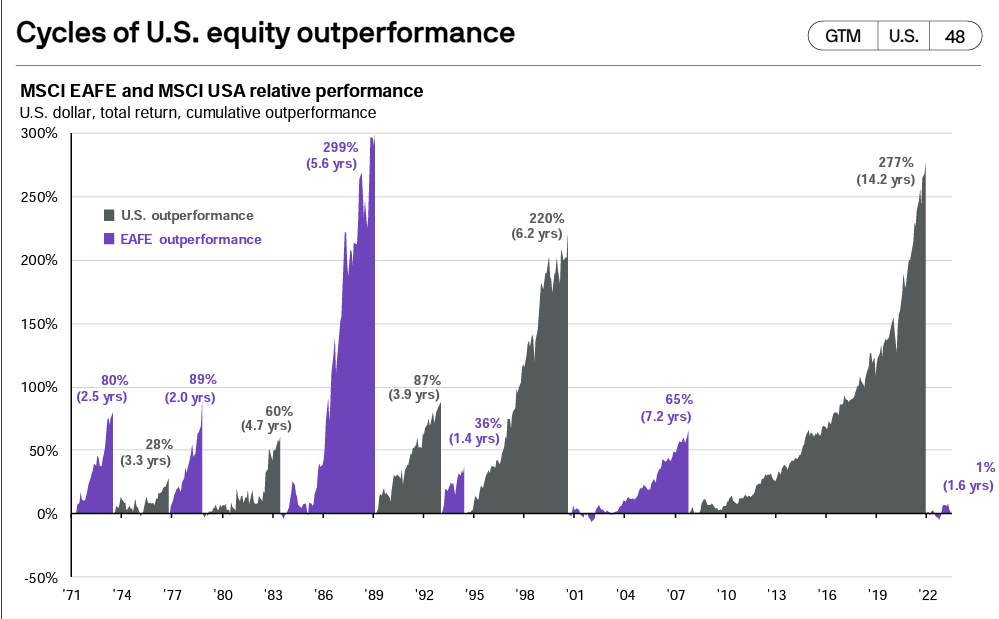

This graph shows the years of outperformance of either the US market or the International market. The purple spikes are the years the international market has outperformed and the gray spikes are the years the US market has outperformed.

Why does it matter:

In 2023, many investors are living with recency bias as they build their investment portfolios. Said more simply, many investors are only remembering what has happened over the past decade. It is hard to blame them when the US market had a 14 years stretch of outperformance over the international market. Yet, stacking the odds requires following the data, not your biases. You see that tiny sliver of purple at the end of the chart? That is the last 1.6 years where the international market has outperformed. Timing either is a losing game. To stack the odds in your favor own both.

3) Value Companies versus Growth Companies

What is this:

The stock market can be split into two types of companies. Value companies (think Mcdonald’s) and growth companies (think Tesla). One is focused on cash flow and one is focused on growth. This chart is showing current valuations of value companies compared to growth companies.

Why does it matter:

There is a lot of talk about the “market” being overvalued. The truth is most of that talk revolves around the S&P 500 as the barometer. The S&P 500 while a solid index is heavily titled towards growth companies. Those growth companies are being valued significantly higher in 2023 than their value counterparts. To successfully stack the odds in your favor it requires owning both growth and value companies.

4) Yields versus Inflation

What is this:

This chart shows the nominal yield, what you actually receive in interest from an investment, versus the real yield, what the net is after you account for inflation.

Why does it matter:

“I can get 3-5% risk-free.” This is a line tossed around a lot in 2023. It is somewhat true. It is also short-sided. While yes some “low-risk” investments are paying nice yields. We have to consider inflation. If inflation is 5.33% as our chart shows (note the 6/30/2023 date) and the average yield is 3.81%. We might feel good about what we are earning but in reality, our money is losing spending power. To better stack the odds in your favor you must always consider the “real” return. This is the return after accounting for inflation.

No one can predict where the stock market is headed next. No one can predict accurately over time which stock will be the next high flyer. What you can do is make sure that you stack the odds in your favor. These charts speak to three key understandings to do just that ~ Diversification, Recency Bias, and Human Psychology. These are three things I am thinking about in 2023 for my clients.

A Money Question

What does financial success look like for you?

A beautiful question to spend a few minutes on. We live in a world that provides inputs 24/7, 365. Those inputs are often meant for someone else, not you. As a result, I have found many times I “thought” I wanted something in my financial life only to realize that was someone else’s dream. Spend a few minutes today and think about what you want.

Work with Jacob

I help athletes, entrepreneurs, and executives pay less in taxes, coordinate their financial life, and invest for the long run.

Until Next Time, My Friends

Moment Private Wealth, LLC is a Registered Investment Advisor, located in the State of Missouri. Moment Private Wealth provides investment advisory and related services for clients nationally. Moment Private Wealth will maintain all applicable registration and licenses as required by the various states in which JL Strategic Wealth conducts business, as applicable. Moment Private Wealth renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion. Nothing in this content is intended to be, and you should not consider anything in this content to be, investment, accounting, tax, or legal advice.