The Type of Account Matters More Than We Think

Today's Newsletter:

Quote From Arthur Godfrey

Type of Investment Accounts

My Current Breakdown

A Money Question

Quote:

"I'm proud to pay taxes in the United States; the only thing is, I could be just as proud for half the money." - Arthur Godfrey

We should all pay what we owe in taxes but leave your tips for date night, not the IRS.

Types of Investment Accounts:

We talk endlessly about the different types of investments available. For 15 hours a day the talking heads in the financial media debate the merits of different company’s stocks.

What if I told you we might be obsessing over the wrong thing?

Great investments all have the same end result, more money in your account. Yet, we often overlook the potential tax consequences and the role the account type plays.

There are three types of investment accounts as it relates to taxes.

Tax-Deferred - These are accounts that are DELAYING a future tax bill. Examples include your 401(k), IRA, and other “traditional retirement accounts”.

Taxable - These accounts are PAY AS YOU GO. Examples include brokerage accounts that are not retirement accounts.

Tax-Free - These accounts are PRE-PAID. Examples include retirement accounts with the ROTH tag in front of them.

The type of investment account is my obsession. How can I position my money strategically into each bucket to lower my lifetime tax bill? How should I position my investments in each bucket? How can I play a lifetime tax game instead of a yearly one?

My Account Breakdown:

We have established the three different buckets our investments can be in.

Tax-Deferred, Taxable, and Tax-Free.

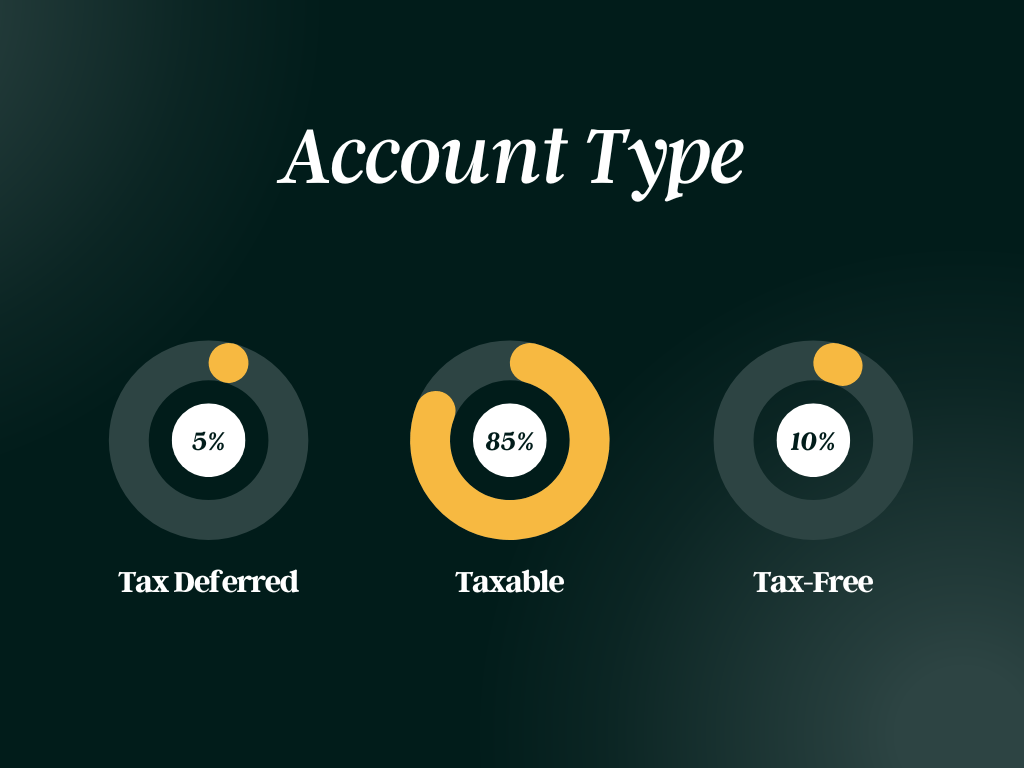

Here is my current breakdown in each category:

The how, why, and what now for each of these accounts.

Tax Deferred

How?

This money has solely come from 401(k) contributions over the past decade.

Why?

Each contribution I made to this account gave me a current-year tax benefit and allowed to me DEFER taxes until sometime in the future. This was beneficial for me as I have spent much of my earning years in the highest tax bracket.

What Now?

I am working to get every dollar in this bucket converted into the Tax-Free bucket. Although I am deferring the taxes now at some point they will come due. I have a long time for these investments to compound so paying some of these taxes now and shifting this money into a tax-free account will pay future dividends.

Taxable

How?

This money has come from savings that exceeded my retirement account contribution limits.

Why?

Each contribution to this bucket provided me with a way to invest now while staying flexible. There are no restrictions on when I can access this money or how much I can contribute. As such, it is the largest percentage of my investments.

What Now?

I am focused on two things with this money. Growing it and keeping the taxes I pay along the way as low as possible. My focus here is on the most tax-efficient investments I can choose. Remember, in this bucket, I am paying taxes as I go so choosing tax-efficient investments is critical.

Tax-Free

How?

This money has come from backdoor Roth IRA contributions and Roth conversions. (More on that in a later edition)

Why?

Each contribution to this bucket I am prepaying my taxes. The money that goes in has already been taxed. The benefit is all the growth of this account will never be taxed again.

What Now?

I am working to move all of the money in the tax-deferred bucket into this tax-free bucket. I will pay more in taxes today but less over my lifetime.

Remember friends, the only way to beat the IRS is to play the game you are uniquely positioned to win. A lifetime game.

A Money Question:

What proactive steps have you taken to reduce your lifetime tax bill?

Work with Jacob

I help athletes and entrepreneurs pay less in taxes, coordinate their financial life, and invest for the long run.

Until Next Time, My Friends

JL Strategic Wealth, LLC is a Registered Investment Advisor, located in the State of Missouri. JL Strategic Wealth provides investment advisory and related services for clients nationally. JL Strategic Wealth will maintain all applicable registration and licenses as required by the various states in which JL Strategic Wealth conducts business, as applicable. JL Strategic Wealth renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion. Nothing in this content is intended to be, and you should not consider anything in this content to be, investment, accounting, tax, or legal advice.