A Better Approach to Spending

Today's Newsletter:

My Latest

A Better Approach to Spending

A Comparison of Two Approaches

A Money Question

My Latest

One issue many of us struggle with is understanding what accounts we should be saving into.

They all sound like Greek with three-letter descriptions and weird prefixes.

In a recent post, I outlined the most common accounts Americans are investing in and what each of them means.

You can check it out below ⬇️⬇️⬇️

A Better Approach to Spending

Go back to the first time you earned money.

For me, it was from helping my dad with projects around the house.

That first $20 bill made me feel like the richest person in the world. Right after thinking that, I began dreaming of all the things I was going to buy with it.

My list looked something like this:

Baseball Cards

Athlete Posters

Sports Equipment

Then I started doing the math and realized that if one of my purchases was $10, I could only buy two before I was out of money.

In my head, it was just a linear math equation: $10 X 2 = $20. That is all the money that I have.

Today, I want to show you how that same thinking follows many of us all our lives.

It leads to a flawed spending formula that has dominated how most spend from their nest egg.

Let’s dive in!

______________________

A Comparison of Two Approaches

To start I need to give you a bit of context.

My typical client has saved enough money that they have created financial optionality.

Some have done that by 30, some have done that by 60.

As I think about each of my client’s specific situations my guiding light remains the same.

Help them to spend more money (on the things they care about) than they would alone.

You see, I firmly believe money is a tool meant to be used and it is our job as their financial team to help them maximize that tool.

Yet study after study shows that many of those same families (high net worth & ultra-high net worth) will leave more money in their legacy bucket than intended.

Said another way, they will not use their greatest tool to its full capabilities.

Look it makes sense, a 2024 study by Allianz Life showed that 63% of those surveyed were more concerned about running out of money than dying.

So, to recap the goal is to use our money but we are so terrified to do it that many of us fear financial ruin more than death itself.

Got it? Now let’s talk about how we can build a framework to spend more and not be so worried about…

Static Spending

Remember my story about my first experience earning money? My first thought after earning it was how I was going to spend it and run out of it.

That same mental psychology has developed the most common spending strategy you will find online ~ The 4% rule.

The 4% rule says this ~ You can safely pull 4% of your investment portfolio each year with little risk of running out of money.

Example: An individual with a $1,000,000 portfolio could spend $40,000 off their portfolio each year with little risk of running out of money.

It is a static-based approach, take your initial number multiply it by a percentage, and stick with it forever.

You see there are two problems I have with this approach (not necessarily the number).

Number 1 is this doesn’t account for life.

You know…that thing that is always changing, evolving, and going in a new direction.

It is this set-it-and-forget-it idea that frankly does not correlate with how life works.

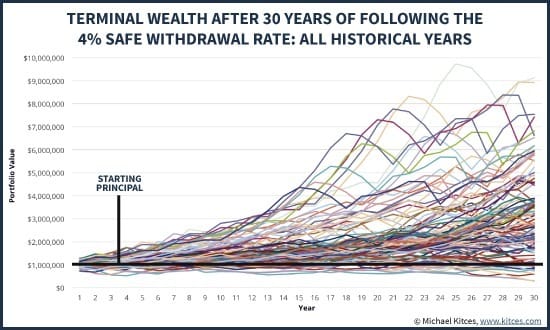

Number 2 is the data behind it.

Consider this, an individual following the 4% rule over 30 years has:

66% of finishing with double the money they started with

Higher chance to 4X their wealth than finish with less than their starting amount

One thing I want to make clear is my issue is not with the percentage alone (4%).

No, my issue is with a spending strategy (static one) that doesn’t correlate in any way with how life and spending money work.

You will never spend the same amount of money year after year.

Life changes ~ goals change ~ circumstances change.

Your spending should change along with it.

So here is how I like to plan for that.

Dynamic Spending

I want us to think about spending in terms of life stages.

Every stage of life we go through whether it is building a family, transitioning kids to college, or being empty nesters comes with its own spending needs.

Needs and goals that will inevitably change as life changes.

Yet when most of us hit “retirement” or the “nest egg spending” stage we build out a plan with no flexibility to adapt to life changes.

To combat this, we focus on a dynamic spending plan for our clients.

Instead of a static percentage that doesn’t adapt to the market or changing goals, it is flexible.

It is a guardrails-based approach and while it is customized for each client the basic premise is this:

We spend more earlier in life than later

We are conscience of market downturns.

We build in room to tighten (or expand) future spending.

It works for our clients because many of our clients have clear buckets of discretionary spending and set spending.

Example: A house and the associated costs are set spending. A yearly vacation is discretionary spending.

Our plan ensures that they can always cover all set spending but provides flexibility on discretionary spending.

While there could be (and will be) years that the discretionary spending needs to tighten, over decades it will allow them to spend more of their money.

Said another way ~ It pushes them to maximize one of their most valuable tools, money.

Life is not static and your spending plan shouldn’t be either.

I firmly believe personal finance is just that personal.

So while there are frameworks (like the 4% rule) that can be a starting point, for many it shouldn’t end there.

______________________

We endlessly obsess about earning, saving, and investing money.

Yet we rarely consider the best way to maximize spending it (while not running out).

Consider a more dynamic approach as a starting point.

Until next time my friends!

______________________

A Money Question

What are your fixed expenses and your discretionary expenses?

I like to think about my spending in these two categories.

This way if needed I can reduce my dictionary spending (eating out, travel, etc..) while not sacrificing my fixed expenses (health, housing, etc..).

It is an approach that can help further optimize spending today and in the future.

______________________

3 Ways I Can Help You

💰 Schedule an introductory call with Moment. We help athletes, entrepreneurs, and key employees build and protect wealth.

📹 Check out my YouTube channel. A safe place to get smarter with your money.

📷 Interact with me on Instagram. Where I provide bite-sized daily content to level up your money game.

Moment Private Wealth, LLC is a Registered Investment Advisor, located in the State of Missouri. Moment Private Wealth provides investment advisory and related services for clients nationally. Moment Private Wealth will maintain all applicable registrations and licenses as required by the various states in which Moment Private Wealth conducts business, as applicable. Moment Private Wealth renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or under an applicable state exemption or exclusion. Nothing in this content is intended to be, and you should not consider anything in this content to be, investment, accounting, tax, or legal advice.